If you don’t know about Instant Credit Online Shopping No Down Payment, you’re in the right place. Discover the world of Instant Credit Online Shopping No Down Payment where your dreams become a reality without any upfront costs.

I discovered the magic of Instant Credit Online Shopping No Down Payment, which changed my shopping game. No more waiting or saving for ages. I could immediately grab what I wanted without worrying about costs. It was like having a shopping superpower, making everything instantly accessible and worry-free.

So, let’s begin with the article. So, you can also have a shopping superpower.

Table of Contents

Instant Credit Online Shopping No Down Payment

In today’s fast-paced digital world, the allure of instant gratification extends beyond just the things we can touch and feel—it’s also about the convenience and efficiency with which we can acquire them.

This is where the concept of Instant Credit Online Shopping No Down Payment comes into play, offering a seamless and practical shopping experience that aligns perfectly with modern consumer expectations.

As someone who has navigated the waves of online shopping trends and financial solutions for years, I’ve witnessed firsthand the transformative impact of instant credit options on e-commerce.

This innovative approach eliminates the traditional barriers to immediate purchases and opens up opportunities for shoppers to acquire their desires without the upfront financial burden.

In this blog, we’ll dive into how instant credit online shopping no down payment works, its benefits, and tips to maximize your shopping experience.

What Does Instant Credit Mean?

Instant credit is like getting a quick yes from a lender to borrow money or buy things now and pay for them later. It happens fast, sometimes in just a few minutes. This means you can shop for stuff like electronics or clothes online or in stores without paying all the money immediately. Instead, you get to pay over time.

Explore the empowerment of financial freedom with Second Chance Credit Cards, offering no security deposit required—a seamless transition to rebuilding your credit with confidence.

How Does Instant Credit Online Shopping Work?

Instant credit is a quick and easy way to borrow money or get permission to buy something now but pay for it later.

Here’s how it works: when you want to buy something, like a new phone or a piece of furniture, but need more money to pay upfront, you can apply for instant credit.

This process is super fast, often taking just a few minutes. You fill out an application, and almost immediately, you find out if you’re approved to spend up to a certain amount.

Once you get the green light, you can use this instant credit to make your purchase immediately, even though you have yet to pay any cash.

Over time, you’ll pay back what you owe, usually with interest. This way, you can enjoy your new purchase without waiting until you’ve saved enough money to cover the full price.

It’s a convenient option for those moments when you need or want something immediately but need some help covering the cost.

Explore our guide on Credit Cards with $10,000 Limit Guaranteed Approval to unlock your financial flexibility and elevate your purchasing power.

Top 5 Websites for Instant Credit Online Shopping No Down Payment

Instant credit online shopping with no down payment offers the convenience of buying now and paying later. This makes it easier to manage your finances while enjoying immediate access to the goods you desire. For online shopping with instant credit and no down payment, there are several websites to check out:

Fingerhut

Fingerhut is a well-known online shopping site that offers various products, including electronics, home goods, clothing, and more. It’s especially beneficial for individuals looking to improve their credit scores, as Fingerhut reports to all three major credit bureaus.

Customers can enjoy an easy application process and are allowed to make monthly payments on their purchases. The platform provides a standard credit card for shopping, making it easier to manage expenses and rebuild credit.

It’s a great option for those who need to make large purchases but prefer to pay over time.

FlexShopper

FlexShopper is a unique platform offering rent-to-own options on various items, including electronics, furniture, and appliances.

Even individuals with low FICO scores can find acceptance here, making it an accessible option for many. The site offers personalized shopping assistance through a feature called Personal Shopper, which helps customers find exactly what they need.

FlexShopper is known for its excellent customer support and has been in the business for over 50 years. It provides a trustworthy and reliable service for those looking to finance their purchases without traditional credit.

QVC

QVC is renowned for its simplicity and ease of use, winning numerous awards for its service. The site allows customers to make purchases using debit or credit cards and even offers the option to rent products over the phone.

QVC’s sign-up process is straightforward, making it easy for new users to start. It combines quality products with easy payment plans, catering to a wide audience looking for hassle-free shopping experiences.

The platform’s customer service is also highly regarded, adding to its appeal as a reliable shopping destination.

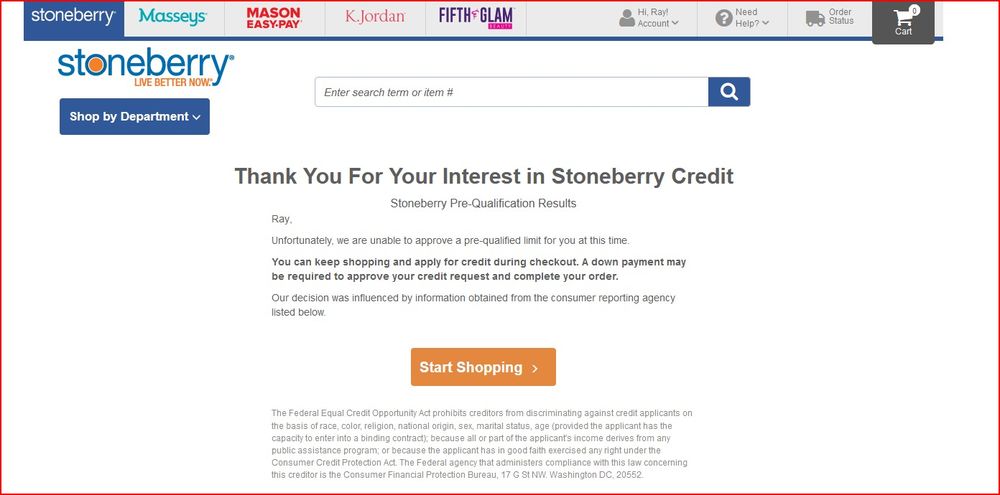

Stoneberry

Stoneberry stands out for its extensive collection of electronics, home goods, toys, and footwear available for rent or purchase. The site offers low monthly payments, making it easier for customers to manage their finances.

Stoneberry also provides a credit card to assist with payments, further simplifying the buying process. The application can be completed online, and the site runs a credit check that doesn’t affect the approval decision.

Stoneberry’s excellent customer support ensures a positive shopping experience, and the site’s installment payments can be as low as $5.99, making it an affordable option for many.

Zebit

Zebit targets customers on a tight budget, offering $0 interest fees and a vast collection of products, including home decorations, electronics, fitness equipment, and more.

The registration process on Zebit’s official website is easy and fast, and no credit score check is involved, making it accessible to a wider audience.

Zebit’s commitment to offering affordable rental terms and managing item prices to suit budget-conscious customers sets it apart from other shopping platforms.

The site also prides itself on its impeccable customer support service, ensuring a smooth and satisfying shopping experience for all its users.

Explore our comprehensive guide on Guaranteed Approval Credit Cards with $1000 Limits for Bad Credit and No Deposit to seamlessly navigate your financial options.

What is the Process for Applying for Instant Credit?

Applying for instant credit can be a convenient way to access funds or make purchases quickly, especially if you need to buy something urgently but don’t have the cash. Here’s why you might consider applying for instant credit and the steps you typically need to follow:

Why Apply for Instant Credit?

- Immediate Access: Instant credit provides immediate access to funds, allowing you to make necessary purchases immediately.

- Convenience: The application process is usually quick and straightforward, often completed online.

- Emergency Use: It can be a useful tool when you need instant access to credit.

- Building Credit: Some instant credit options can help you build or improve your credit score if they report to credit bureaus and you manage the account responsibly.

Steps to Apply for Instant Credit:

- Compare Your Options: Look at different credit providers to find the one that best suits your needs. Consider factors like fees, interest rates, and rewards programs.

- Check Eligibility Requirements: Ensure you meet the basic eligibility criteria set by the credit provider, such as minimum income, age, and residential status.

- Gather the Necessary Documents and Information: Prepare the required documents and personal information, such as proof of identity, employment details, and income verification.

- Apply Online: Most instant credit applications can be completed online. Please fill out the application form with the necessary details and submit it. The response is often received within 60 seconds.

What if You’re Not Instantly Approved?

If your application isn’t instantly approved, it doesn’t necessarily mean it’s denied. Sometimes, the provider needs more time to review your application. You might be able to call the provider for an update or ask for reconsideration.

Banks That Offer Instant Card Numbers:

Some banks and credit card issuers, like American Express and Bank of America, provide instant card numbers after approval, allowing you to use your credit immediately for eligible purchases.

Remember, while instant credit can offer immediate financial relief, it’s important to use it responsibly to avoid accumulating debt or negatively impacting your credit score. Always read the terms and conditions carefully and understand the repayment requirements.

Achieve Your Financial Goals with No Credit Check Credit Cards Instant Approval No Deposit

App for Instant Credit Online Shopping No Down Payment

While credit check apps will not improve their credit score since they don’t report to credit bureaus, buy now, pay later apps can help many borrowers looking for flexible installment plans.

Klarna

Klarna is a Swedish payment service provider that offers online shopping and payment solutions. It allows customers to shop now and pay later, either within 14 or 30 days after purchase, without interest or fees, or through financing options that spread payments over a few months.

Affirm

Affirm is an American company that offers a flexible payment solution for online and in-store purchases. It allows customers to pay over time with transparent, simple-interest loans rather than deferred interest or hidden fees. The terms and conditions, including interest rates, depend on the purchase and the retailer.

SplitIt

SplitIt allows consumers to use their existing credit cards to break down purchases into monthly payments without interest or needing a new credit application. It leverages the available credit on a customer’s credit card, freezing the amount but charging incrementally as payments are made.

Afterpay

Afterpay, an Australian financial technology company, offers a payment solution that allows customers to purchase and receive items immediately while paying for them in four installments, due every two weeks without any interest, as long as payments are made on time.

Benefits of Instant Credit Online Shopping: No Down Payment

Instant credit online shopping with no down payment is a great way to shop because it lets you buy things now and pay for them later. This is helpful if you need more money or want to keep your cash for other things. Here are five creative and helpful benefits of using instant credit with no down payment for online shopping:

Flexibility in Payments: You can choose how to pay back the money. Some plans let you pay back in equal parts every two weeks or even give you more flexible options, like paying every month. This makes it easier to handle your money without feeling too much pressure.

No Upfront Cost: One of the best things is that you often don’t have to pay anything when you buy something. It means you can immediately get what you need or want without waiting until you have enough money.

No Credit Check: Some services let you shop with instant credit without checking your credit score. It’s great if your credit score isn’t perfect or if you’re trying to avoid hard inquiries that might lower it.

Build or Improve Credit: If you choose a service that reports your payments to the credit bureaus, paying on time can help you build or improve your credit score. It’s a smart way to shop and boost your credit simultaneously.

Wide Range of Products: You’re unlimited in what you can buy with instant credit. Whether it’s furniture, electronics, or even clothes, you can get various items immediately without paying. Some platforms even offer wholesale prices, giving you more for your money.

These benefits show how instant credit online shopping with no down payment can make shopping easier and more accessible, especially if you’re careful to pay back on time to avoid any extra fees or charges.

Instant Credit Online Shopping No Down Payment Drawbacks

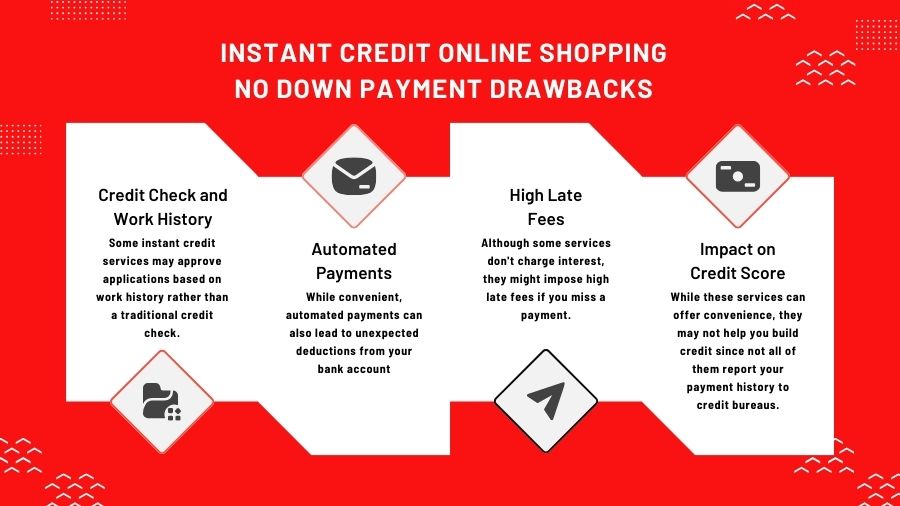

Using instant credit for online shopping with no down payment can be very convenient, but it also comes with some drawbacks that are important to consider:

Credit Check and Work History: Some instant credit services may approve applications based on work history rather than a traditional credit check. It might limit options for those without a steady job history.

Automated Payments: While convenient, automated payments can also lead to unexpected deductions from your bank account, which can be problematic if you’re not closely monitoring your finances.

High Late Fees: Although some services don’t charge interest, they might impose high late fees if you miss a payment. It can significantly increase the cost of your purchase.

Interest and Fees on Credit Cards: If you’re using a service that charges your credit card, you might avoid interest from the service itself but still face interest and late fees from your credit card company if you don’t pay off the balance in time.

Limited Availability and Restrictions: Some buy now, pay later services may not be available in all states, or they might have transaction limits that could restrict your purchasing power.

Impact on Credit Score: While these services can offer convenience, they may not help you build credit since not all of them report your payment history to credit bureaus. Moreover, if they do report late or missed payments, it could negatively affect your credit score.

FAQs for Instant Credit Online Shopping No Down Payment

What Reliable Websites Let You Buy Now And Pay Later Without Checking Your Credit?

Several BNPL services offer the convenience of shopping without immediate payment and without conducting hard credit checks. Services like Afterpay, Klarna, and Sezzle allow you to purchase and pay in installments. These platforms typically perform a soft credit check, which does not impact your credit score.

Where Can I Find Buy Now Pay Later With Bad Credit?

If you have bad credit, you may need better access to BNPL services like Afterpay, Klarna, and Sezzle. These services often focus on your ability to make installments rather than your credit history. They usually require that you have a valid bank card for payments.

Does Walmart offer Buy Now, Pay Later Guaranteed Approval?

Walmart offers BNPL options through partnerships with various financial technology companies, such as Affirm. While not all BNPL services guarantee approval without a credit check, Affirm conducts a ‘soft’ credit check to verify your eligibility.

Does Afterpay Do Credit Checks?

Afterpay performs a soft credit check when you create an account or attempt to make a purchase. This is to verify your identity and assess your ability to repay. However, this soft check does not impact your credit score, making Afterpay a viable option for those concerned about credit inquiries.

Does Buy Now, Pay Later Affect Your Credit Score?

Buy Now, Pay Later services can affect your credit score, but how they do so varies. If the service reports to credit bureaus, timely payments can positively impact your score, while late payments can negatively affect you.

Conclusion

Instant Credit Online Shopping No Down Payment offers a convenient and flexible way for consumers to make purchases immediately while spreading the cost over time. With services like Klarna, Affirm, SplitIt, and Afterpay, alongside platforms like Fingerhut and FlexShopper, consumers have various options to suit their financial situations and shopping needs.

While this shopping method provides significant benefits, including no upfront costs and the potential to build credit, consumers must use it responsibly. Awareness of terms, potential fees, and the impact on personal finances is key. As a modern financial tool, instant credit can enhance purchasing power when used wisely, aligning immediate desires with long-term financial well-being.

![Federal Employee Payroll Deduction Loan No Credit Check [Explained]](https://abilityhere.com/wp-content/uploads/2024/03/Federal-Employee-Payroll-Deduction-Loan-No-Credit-Check-Explained-74x55.jpg)

Add Comment